Commission tax calculator

Multiply price by decimal. Read reviews on the premier Commission Tools in the industry.

How To Calculate Real Estate Commissions 10 Steps With Pictures

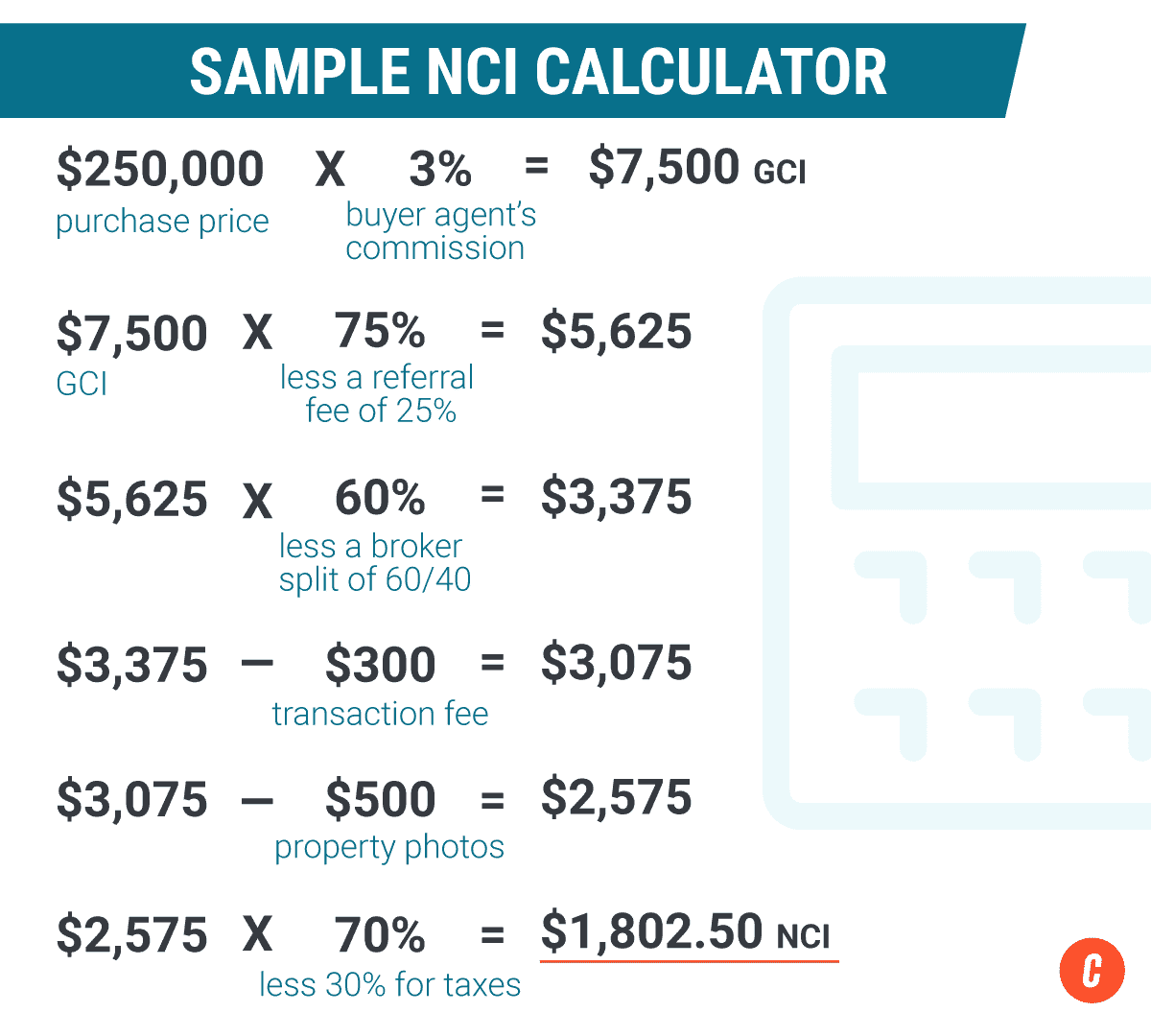

Estimated Property Tax.

. Using the United States Tax Calculator is fairly simple. Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X Statement of Commission Income and Expenses for Payroll Tax. Real_revenue sale_price - sale_price commission_percentage 100.

List price is 90 and tax percentage is 65. Enter the commission percentage. Federal Bonus Tax Percent Calculator.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Tennessee Income Tax Calculator 2021.

For example if your bonus or commission is included in your regular pay then its taxed according to normal. Aggregated Annual Taxable Income. 65 100 0065.

Select the calculation mode you want to use. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Use our payslip calculator to check the correct tax and other deductions have been made fully updated for tax year 2022-2023.

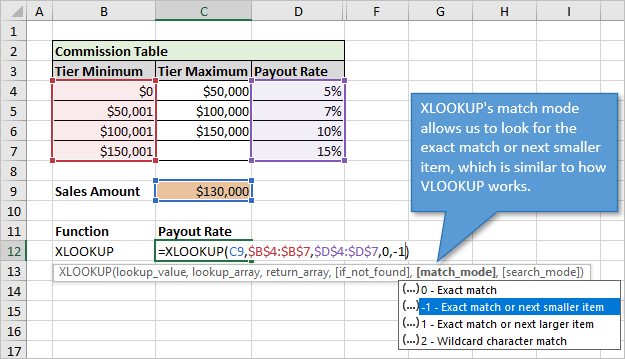

The price of the coffee maker is 70 and your state sales tax is 65. Divide tax percentage by 100. 3 Formulas for Calculating Tax on Commission.

Ad See the Commission Tools your competitors are already using - Start Now. Your household income location filing status and number of personal exemptions. - Real Estate real.

Get an estimate of your property taxes using the calculator below. Your household income location filing status and number of personal exemptions. You can enter your basic pay overtime commission.

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. To calculate their revenue we need to calculate the percentage decrease. If you make 70000 a year living in the region of Tennessee USA you will be taxed 8387.

With this method your tax is calculated by multiplying out your monthly earnings ie. - Standard a standard commission calculator or. First enter your Gross Salary amount where shown.

Commission Calculator YSNM Support 2021-12-10T114700-0600. Select the brokerage plan. If your state does.

Just follow these 4 easy steps to determine the commission amount. Your average tax rate is 1198 and your marginal. Use the relevant tax table.

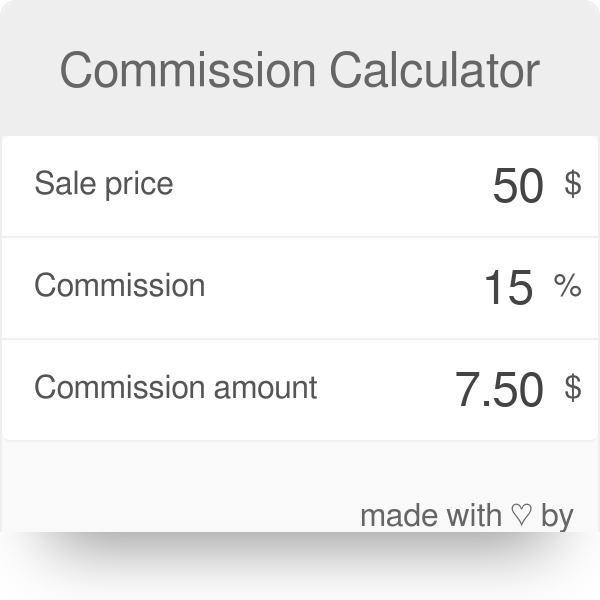

You can calculator your commission by multiplying the sale amount by the commission percentage. Enter gross volume sold. Next select the Filing Status drop down menu and choose which option applies.

In other words if you make a sale for 200 and your commission is. The taxes are calculated based on how your employer pays you normally. We can only provide estimates for the counties listed in the drop-down menu.

Calculate the average total earnings paid to your employee over the current financial year to date. In our example its 70 -.

What Is Gci Why It Matters To Every Real Estate Agent

How To Calculate Commissions In Excel With Vlookup

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Nsb Tax Calculator Schools Editable Sheet In Ms Excel Format Calculator Download Link Https Www Mediafire Com Download 9k1c45do5n2fxvx Help In By Zia Bwn Facebook

Bc Income Tax Calculator Wowa Ca

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Quebec Real Estate Commission Calculator Wowa Ca

Paycheck Calculator Take Home Pay Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Commission Calculator

Sales Tax Calculator

Canada Capital Gains Tax Calculator 2022

2021 2022 Income Tax Calculator Canada Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps